Corporate Governance

Getting It Right

Digicel is committed to maintaining robust Governance structures and practices. This starts at the Board level and permeates throughout the company, enabling ethical decision-making, promoting compliance and accountability, and fostering a culture of diversity, integrity, growth and innovation. Good governance enhances our viability and reputation while mitigating risk. In addition to our Board of Directors, we have in place the following Board committees to as part of our governance framework: Audit Committee (AC); Remuneration, Appointments and Human Capital Committee (RAHCo); and Compliance Special Committee (CSC).

Our Team

Board of Directors

Mariame McIntosh Robinson

Senior Leadership Team

Board Responsibilities

Our Board provides strategic direction and drives our business forward.

Digicel Group is governed through its Board of Directors and three Committees of the Board. These three committees are; the Audit committee, Remuneration Appointments and Human Capital committee and Compliance Special committee.

Audit Committee

Our Audit Committee ensures we are on the best financial footing possible providing extensive financial oversight including supervision of key activities such as the audit process, investor reporting, and our financial internal controls. Its mission is always to focus on the financial position and help to set a good tone at the top in regards to financial risk management, demonstrating that this is core to a successful Digicel. It also gets involved in any governance, legal or regulatory matters which fall under its scope ensuring that we always remain compliant with all laws and regulations.

Remuneration Committee

Our Remuneration, Appointments and Human Capital Committee is responsible for everything people-related. We recognise that our people are one of the most valuable resources we have and ensuring that our policies and practices in this regard support our strategy and long-term sustainable success is vital. All things remuneration, conduct, performance and succession-related falls under its purview and, with the support of the full Board, should enable us to achieve our goals and ambitions. For us, it’s important that our staff feel valued and that our top tier talent is put to good use in growing both the business and the individual.

Compliance Special Committee

Our Compliance Special Committee is responsible for governance and oversight of ethics and compliance at Digicel, including overseeing Digicel’s compliance with laws and regulations, supervising and developing an overall compliance strategy, and evaluating compliance with relevant policies, procedures and ethical standards. Overall, our CSC plays a crucial role in developing a culture of integrity and compliance, fostering a continuous learning environment ensuring that our compliance processes are responsive to the ever-changing needs of the organisation across all lines of our business from regulatory requirements to investigations and remediation.

| Board |

Audit Committee |

Remuneration, Appointments and Human Capital Committee |

Compliance Special Committee | |

|---|---|---|---|---|

| Corporate Strategy | ● | |||

| Legal and Regulatory | ● | ● | ● | |

| Ethics and Compliance | ● | ● | ● | |

| Risk Management | ● | ● | ● | |

| Financial Management | ● | ● | ||

| Privacy and Security | ● | ● | ||

| Environment | ● | ● | ||

| People | ● | ● | ||

| Inclusion and Diversity | ● | ● | ||

| Succession Planning | ● | ● | ● | |

| Governance | ● | ● | ● | |

| Mission and Values | ● | ● | ||

| Policies and Procedures | ● | ● | ● | ● |

| Board | Audit Committee | Remuneration, Appointments and Human Capital Committee |

Compliance Special Committee | |

|---|---|---|---|---|

| Rajeev Suri | C | O | ||

| Marcelo Cataldo | ● | O | ||

| Rodrigo Diehl | ● | ● | ● | |

| Alberto Griselli | ● | ● | ● | |

| Mariame McIntosh Robinson | ● | C | ● | |

| Denis O’Brien | ● | |||

| Tarek Robbiati | ● | C | ● | |

| Rachel Samren | ● | O | C | |

| Xiao Song | ● | O |

Key

C - Chairperson

O - Observer

● - Member

Our Strategic Risk & Governance

We continue to enhance our Governance structure and practices to manage our risks. We understand how pivotal it is for us to get our strategic risk design right and effectively manage through the uncertainties which face our markets enabling us to grow sustainably. When assessing the strategic risk, we look at four aspects of our business, financial, legal, operational and strategic. Different risks will require different solutions and looking at all aspects means we have the best understanding to optimise and lower the risk to levels we deem acceptable. We are constantly looking to remain agile and therefore our risk strategy encompasses four aspects:

Financial Risk Management

Our Audit Committee oversees the financial risks and strategy setting that strong tone at the top which filters down to all of our people and is exemplified throughout our financial community. We also have specialised teams who focus on specific aspects of our operations helping to further reduce our risk. Our business risk and corporate security team mitigates the risk of fraud, revenue leakage and operational matters like the sensitive disclosure of business records. We take this very seriously and any instances are reported and analysed to continuously improve our operations and policies. In further support of managing our financial risks is our internal audit function. Our teams assess the integrity of our financial processes and perform substantial controls testing across all our markets, making sure our controls and processes are working as designed and being followed by all our teams across all our markets. It is only by applying this diligence that we are able to ensure that the quality of our information is up to scratch and fit for purpose.

Disaster Risk Management

Given the possibility for many of our markets to be hit by natural disasters, it will come as no surprise that we are prepared for the worst and ready to step up when the time comes. Our teams are always ready to activate and have numerous playbooks ready for when the worst does happen. All our people must complete disaster awareness training each year to make sure that they know what to do in the most likely scenarios and training drills are held throughout the year. For those teams on the front line, the training is even more intense. Our technology teams who go out in the worst conditions have drilled into them the importance of keeping our customers connected while mitigating potential risks to themselves and our infrastructure. Ensuring that our customers remain connected is top priority and speed of recovery is everything.

1. Identification

Finding the risks within the organisation

2. Assessing the Risk

Evaluating the risk from the four different pillars

3. Mitigating or Preventing the Risk

Putting in controls or processes to bring the risk within acceptable levels

4. Monitoring and Reporting

Ensuring that we maintain and check that our controls are working and that we adjust as necessary to a changing world

We are committed to providing important information to our investors and stakeholders, keeping them abreast of the health of our business and our financial metrics.

Calendar

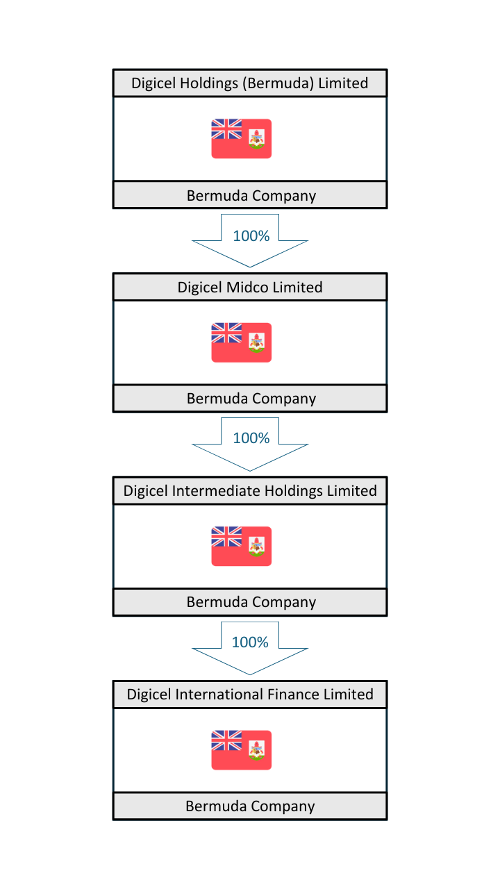

Corporate Structure

Our Group Structure and Leverage Information Within Our Organisation

Ensuring our investors understand our structure and leverage at the different levels within the company is a top priority.

We have always understood that it is our duty to work in tandem with our customers and other partners to ensure we operate responsibly.

Sustainability

Learn More about Our Commitment to Continued Service to Bridge the Digital Divide

Our focus is on providing ubiquitous access to all through our superfast sustainable networks and we are committed to enabling our customers to operate at the forefront of the global knowledge economy and helping to bridge the digital divide.

Privacy

Trust and Confidence is Paramount. Find Out More about How We Protect Your Information.

Our objective is to maintain stakeholder trust and confidence through responsible data management. We pride ourselves on employing the highest standards of security to protect personal data and we are dedicated to recognising and respecting privacy rights in all our markets.

Our Ethics & Compliance Strategy

How we do things is just as important as what we do. This means doing things right and doing the right things while ensuring that we have knowledgeable staff who know how to conduct themselves appropriately. This better prepares us to identify and solve any issues and concerns before they escalate. Our Code of Conduct lays the foundation for our Ethics and Compliance Program by outlining our ethical standards and reinforcing our commitment to integrity, inclusivity, transparency and compliance with applicable laws and policies.

Our people understand that compliance is a shared responsibility and we all have a part to play in ensuring that Digicel remains compliant in all our dealings. One of our priorities during FY24 was to bolster our governance and build upon the strong foundations that exist within our organisation. We recognise that ethics and compliance promote fairness, transparency and accountability, which results in better outcomes for us, our customers, our investors, our communities and our partners

Our Strategy Encompasses These Three Key Aspects

Prevent

Preventing and mitigating risks by conducting risk assessments, establishing policies and procedures, and providing training to raise awareness about legal requirements and ethical standards.. This is all about getting the right policies, processes and controls in place, making sure all our stakeholders understand our expectations.

Detect

Detecting weaknesses and potential misconduct through our enhanced controls and speak up process. If our controls are working, then we should see the benefits throughout the organisation from reduced fraud through to greater efficiency within our operations.

Respond

Responding and taking corrective action will define how successful we will ultimately be. To manage risks successfully, we will need to be innovative and constantly adapt to the changing landscape making sure any misconduct is addressed in a fair and transparent way

Contact Us